Before we look at how you might use the EIDL or for that matter, any other financial support, that’s start with the basics.

Just what is an EIDL?

The EIDL (Economic Injury Disaster Loans) is a low interest loan issued by the US Small Business Administration (SBA) targeted at aiding small businesses during times of difficulty. It’s a temporary measure that is triggers on a county or state level basis once they’ve received notification that is triggered by a declaration from the SBA.

There are conditions behind the qualification for an EIDL with the key one being that your small business has to show a loss effective from the start the calendar year (for Covid it’s January 31, 2020), to now and/or in the future, as compared to previous years financials (2019 for Covid relief).

An EIDL loan can be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact and is charged at 3.75% for with-profits and 2.75 for non-profits. Payments are not due for the first four months and the payments terms can extend out to a maximum of 30 years. Finally, an EIDL is capped at $2M USD.

I’ll provide some key links at the end of this feature if you want to know more or wish to apply for an EIDL.

And now to what’s next

So, you have access to short term funding at what is hopefully great terms, you can afford to make payments at the moment and you’re now going to carry on as you were? Hopefully not. There’s always the option to do nothing or to simply carry on as you were but kicking the ball down the road isn’t really sustainable. Change as they often say ‘is optional, survival isn’t mandatory’.

I can draw a fairly simple analogy for you by referring back to my first career, the UK military where at one point I was an instructor. One of the key manuals we used in the early phases or training was ‘Survive to Fight’. The concept was remarkably simple, in order to be an effective soldier, you first had to survive, to be able to keep going and reach the battlefield. Covid is our battlefield and we need to survive it.

The reality is that you’ve had to take funding because something changed, something happened, as I write this, Covid landed with a huge splash upon both society and the business economy. One or more disruptors came into your life and that of your business and things have changed. Some of that was as a direct impact of local regulation, customer behaviour, the loss of trading partners, reduced sales. The Covid ‘Splash’ has driven something we’ll call a ‘Ripple Economy’. Please let me explain as it sounds like one of those crazy business management terms.

The Ripple Economy

The Ripple Economy as it relates to Covid (and pretty much any other key change/ incident) reflects, as shown in the image below, that the touch point is only the start of any change. There is an initial splash which then dissipates reducing in size and impact but nevertheless extending outwards way beyond the initial touchdown point. In business you’re feeling the pain because of the ripple effect. You may be on the edge but as it ripples outwards, it becomes inevitable that there will be a wave, be it large or small.

Covid however has brought with it a variation to the standard picture. There are multiple ripples to contend from the loss of customers, changes in regulations such as customer access, closure, furlough’s, just to name a few. If you take the picture below you can see that the ripples take on a new dynamic. We are now contending with multiple ripples from varying directions and the strength and therefore the impact of each of those ripples varies making for a much more complex business environment.

As the ripples settle in a different form. The easiest way to picture this is through the use of multiple colours. If each ripple has its own influence, multiple ripples result in a change in overall status as the ripple subsides.

From a business perspective it’s safe to say that the new Ripple Economy, where there are many, pronounced ripples, will leave a very different environment from where we started. Yes, we can carry on as we were but it’s much better to accept that things have changed and to try and use the time that EIDL funding and other such initiatives gives us. We need to adapt to a changing environment.

So, what do I do next?

OK, let’s assume that we agree that there is such a thing as a Ripple Economy and that Covid has brought with it the acceptance that we need to adapt for the future. That to carry on as we were, will not ensure continuity or survival in the future. You need to change what you do, how you do it, where you do it, when, or even a combination of two or more of these dynamics.

We know we need to change, what you’re probably asking now is what do I change, when and how? They’re reasonable questions especially in light of the fact that we are still working in a rapidly moving Ripple Economy where there are possibly more ripples to come.

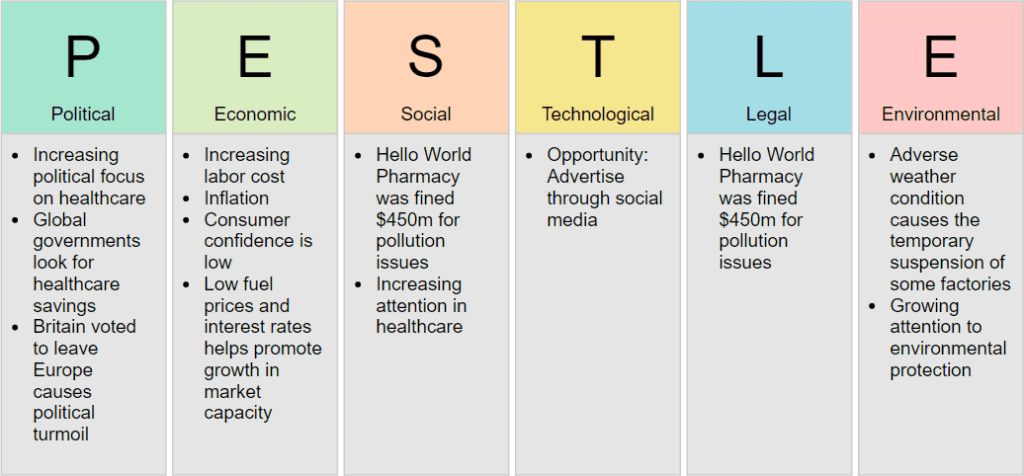

There are a number of tools that we can use to understand our current environment and how we might adapt. The first tool that we will discuss, PESTLE, is a great yet fairly simple tool to help define where you are, what’s happening and it can help to serve as a Ripple Radar to try and understand those ripples, where they are coming from, and what the potential risk is behind each of those ripples.

The second tool is used to analyse how you sell according to your product base, customer demographics, pricing, and marketplace. This is in marketing circles known as the Four P’s.

I’ve explained as simply as possible below how each of these tools may assist in your analysis and planning.

PESTLE

PESTLE can seem daunting at first, but the concept and application can eb kept fairly simple. If we break our current-state environment into six categories, we can draw up a picture of where the risks to our business operation may come from. Once know, we can then prepare either contingencies or resolutions to ensure that we change the picture and minimise or remove the risk.

To effectively use PESTLE to capture and then plan for change each of those categories should be analysed in isolation to build up the picture. Each vertical (see above) should be lead by an individual who can take an objective review ensuring that no consideration is given to ‘We always do it like that’, or ‘It’s not relevant’, ‘I know best’, statements. It’s better to capture any and all influences at the outset, they can be examined and dismissed later in the process if necessary.

I’ve listed below some considerations/ areas of contemplation.

Political Considerations:

Government Policy, Political Stability, Tax, Industry Regulations, Trade Agreements

Economic Considerations:

Exchange rates Globalisation, Economic growth / decline, Inflation, Interest rates, Cost of living and Labour costs, Consumer spending habits

Social Considerations:

Consumer trends /tastes, Fashions, Consumer buying habits, Lifestyle factors, Career attitudes, Work-life balance, Population demographics

Technology Considerations:

Automation, Innovation, Disruptive technologies, Social networking, Upgrades, Robotics, Artificial Intelligence, Security

Legal Considerations:

Employment law, Common law, Local labour law, Health and safety regulations

Environmental Considerations:

Environmental restrictions imposed by in-country governments, Sustainable resources, CSR (Corporate social responsibility), Ethical sourcing, Transportation, Procurement, Supply chain management

Once PESTLE has been objectively compiled its then much simpler to share/ communicate the current state, identify potential changes, and plan for an approach as to how you can remove or mitigate the influence of each of the verticals. As you plan for the future-state its always prudent to rerun the PESTLE analysis to see if any new items have been identified that may influence future stability.

The 4 P’s

All business offer products or services to one or more clients and we’re blessed with a simple tool to help us understand the basics of sales and marketing, putting the right product in the right place, at the right price, at the right time. It’s that simple yet its a picture that very few businesses have ever defined let alone maintained.

Do you know and have you captured what you’re selling, to whom, at what price, and where do you communicate/ share that offering? It may have been a conversation at some point in the past but its typically rapidly discarded/ ignored/ not maintained. To ignore it all is far from ideal, to even exclude one of the four P’s is to invite problems. They’re every much interlinked. If you change one, you should always change/ review the other three.

The 4p analysis can be undertaken as a standalone activity or in conjunction with the PESTLE analysis and planning activities. I’d always recommend to run the two side-by-side. As you complete your PESTLE planning and remediation work its crucial to understand what and/ or how the proposed changes impact upon the business 4P strategy. Indeed, you’ll find that you will probably refine the two alongside each other at least once or twice.

Next Steps

Hopefully you now have an understanding of the need for change, you have tools to analyse the current state and to help plan the future-state changes. You just need to implement it.

It can be daunting to even consider the analysis and planning for some or, you may be confident enough to start the process. To do nothing, is to invite huge risks, to create a very real threat to your business. If you’re not confident to start or complete the analysis or planning process yourself, don’t give up. There is a very real need to adapt to the Ripple Economy that’s underway if you are to survive and adapt.

A Ripple Economy offers real opportunities to not only adapt but to grow as others ignore the need for change or make change in an unstructured way. Those that adapt, survive. Make sure you’re one of the long-term survivors and you’re ready to continue when the external funding runs out. Now is the perfect opportunity.

If you’re not ready to change, there are experts you can reach out to for help.

About the Author

Rachael Evans is a Business Management Consultant, former FX Trader, Senior Vice President at Bank of America, Interim COO of the Bank of London Middle East, she has consulted for HSBC in London, Credit Suisse and UBS in Switzerland, and Morgan Stanley in New York as well as supporting numerous other international organisations across the globe for over 25 years. She is a published business author who has completed multiple post-grads, is currently researching for her PhD and she adores supporting SME’s in identifying and adapting to the changing business world. Rachael’s Management Research was recognised with her appointment as a Fellow with the UK’s Chartered Management Institute. Away from work when not spending time with her family, she is a very bad Jazz Guitar player and she collects and uses 1950’s to 1970’s portable typewriters.

EIDL Appendix

LINKS

EIDL Information :https://disasterloan.sba.gov/ela/Information/EIDLLoans

To Apply for an EIDL Online :https://disasterloan.sba.gov/ela/

To Apply for an EIDL via Paper Forms :https://disasterloan.sba.gov/ela/Information/PaperForms

The Process: https://disasterloan.sba.gov/ela/Documents/Three_Step_Process_SBA_Disaster_Loans.pdf

EIDL Requirements

- Tax Information Authorization (IRS Form 4506T) for the applicant, principals and affiliates

- Complete copies of the most recent Federal Income Tax Return.

- Schedule of Liabilities (SBA Form 2202).

- Personal Financial Statement (SBA Form 413)